Resources For Financial Advisors

- Process designed to avoid estate plans that don’t work

- Preparation

- Maintenance

- Legacy

- Education about how estate plans should work

- Analysis of the client’s individual situation

- Review financial situation

- Review current estate plan to determine weaknesses

- Provide specific recommendations

- No cost for initial consultation

- Fixed fees

- Funding capability

- Reduced settlement costs

- Team-based approach with CPAs, Financial Advisors, etc.

- Ensuring proper trustees

- Bringing the next generation into the planning process

- Multi-office, multi-attorney firm instead of a “one horse show”

- Asset protection techniques offered

- Knowledge of advanced planning techniques

- Do you have a Revocable Living Trust to avoid probate and ensure disability planning?

- Have you re-titled your assets into your living trust to avoid probate and avoid unintended tax consequences?

- If married, have you divided your assets into both husband’s and wife’s revocable living trusts to ensure maximum use of tax credits?

- If married and you and your spouse own all assets jointly and have each other as beneficiaries on IRA’s and life insurance, are you aware wills will not be effective and may cause unintended tax consequences and distributions upon the first death?

- Are you using Tenants by the Entirety and/or Joint Tenants with Rights of Survivorship which may cause unintended tax consequences?

- Have you created new Health Care Powers of Attorney since 2003 with required HIPAA language?

- Have you left assets to your spouse, children or other beneficiaries in such a way to protect them from creditors, judgments and divorcing spouses?

- Do you own insurance in your own name in such a way that will cause unintended tax consequences?

- Have you put personal property into your trust through the use of a Quitclaim Deed to avoid probate?

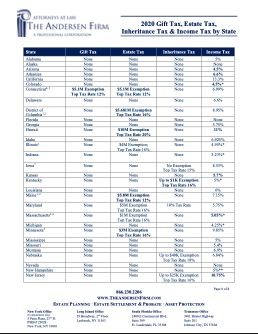

- Do you own property in or are you a resident of another state? If so, are you aware of the rules on state estate tax and ancillary probate?

- If you own an IRA or 401(k) and are planning on rolling over to an IRA, have you planned on how to control the distributions?

- Would you like a review of your current estate plan?